Delivering financing is a sure way to pay for unexpected costs otherwise high expenditures particularly property renovation, school tuition, or a deposit into a residential property.

But there are numerous variety of funds that will help reach these types of wants, also household guarantee funds and private financing. If you’re these two choice could offer your a lump sum payment of money, the two are not compatible. One is significantly more suited to smaller financing wide variety, is easier in order to qualify for, and will charge you much more. The other even offers large sums, straight down rates, and longer loan conditions.

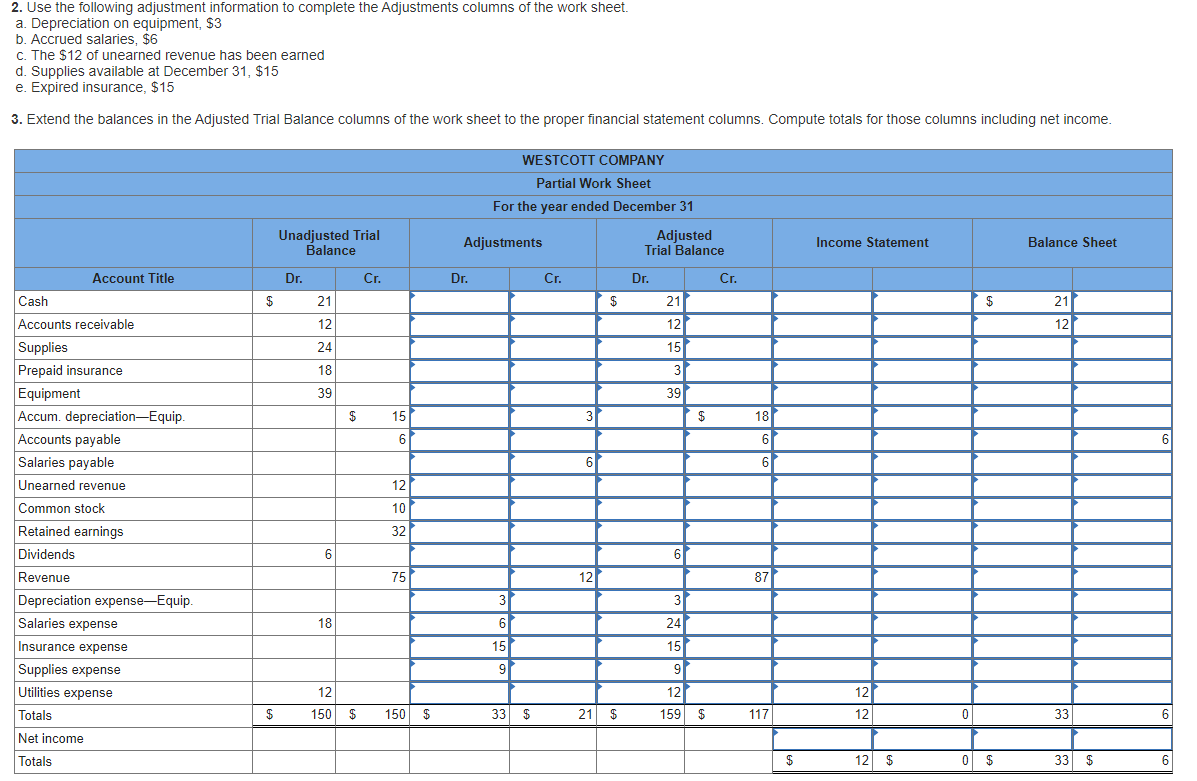

Domestic security money vs. personal loans

Household guarantee loans and private fund are two methods borrow money. Which have a property collateral mortgage, you borrow on the new guarantee you’ve got in the house (the area you really individual) in exchange for a lump sum. This type of money are often awarded by banks, borrowing unions, and you may mortgage lenders.

Unsecured loans, additionally, require no collateral (we.age., a secured asset a lender accepts once the coverage to possess stretching financing) and are generally available courtesy extremely loan providers and you may loan providers.

Personal loans are available to those who dont individual a property, says Barry Rafferty, elder vice-president away from capital segments in the Get to. Unlike household security, lenders create decisions centered on money, credit score, and you will obligations-to-money proportion.

In the two cases, borrowers get an upfront lump sum payment, as well as fixed interest rates and you will consistent monthly premiums along the lifetime of the loan.

Even after their similarities, regardless of if, household equity finance and personal financing are not you to and same. See the secret differences between these type of funds lower than.

What’s a home equity financing?

A property guarantee mortgage is financing using your own equity stake-the house’s really worth, without what you owe in clickcashadvance.com where can i borrow money online it-due to the fact leverage. Then chances are you score a fraction of you to definitely equity into dollars.

You can get property guarantee financing to have sets from $5,100 so you can $five hundred,000, with respect to the limitations at lender, claims Nicole Rueth, elderly vice-president of Rueth Group within OneTrust Lenders.

Household security loans are officially a form of 2nd mortgage, definition these include under towards the fundamental financial. If you can’t build costs, your main home loan company features a state they our home earliest, followed closely by your property collateral financial. Likewise, family guarantee money put the next monthly payment with the house (near the top of your main homeloan payment).

Exactly how domestic collateral finance works

When taking away a property security financing, you will get a lump sum payment once closing. One to balance-plus appeal-was pass on across the all your mortgage identity, that will diversity from five so you’re able to three decades. Since interest rates throughout these money are repaired, your instalments will stay uniform for your label.

Discover a home collateral loan, you need to be a homeowner and have repaid a good fair share of financial. Very mortgage brokers require that you enjoys at the least 10% so you can 20% guarantee of your home. So you’re able to calculate your own equity, take your residence’s reasonable market value (you can examine with your regional assessment region because of it) and subtract your financial harmony. Then separate one number by the house’s well worth. Such, if for example the residence’s value $five-hundred,100 as well as your home loan equilibrium is $400,one hundred thousand, you may have $a hundred,one hundred thousand in home guarantee-otherwise 20%.

- Good 680 credit score or even more

- A 45% debt-to-income proportion (DTI) otherwise all the way down

- Only about a good 90% loan-to-worthy of (LTV) proportion

Specific loan providers may approve consumers external these conditions, so if you’re unsure you can be considered, thought looking around before applying.