When there is anything you absolutely should do when buying a good home, its bringing property examination. Inspections is actually total studies out of a great home’s updates and you may aware consumers to virtually any biggest circumstances-frequently occurring ones tend to be roof points, electronic issues, screen and you will door items, base problems, or chimney ruin. Buyers generally pay money for their property check, but vendors just who is generally worried about findings sometimes opt to purchase good pre-assessment. Never waive a property evaluation-it could pricing a chunk out-of alter today, but it will probably save you big fundamentally.

Think possible repairs

Make sure you research past merely the homeloan payment about if you really can afford they. Domiciles requires repairs. Kaitlyn R.

Buy on the cheap than simply your finances to help you have the solutions complete the right path. Don’t faith brand new suppliers to discover the fixes done totally or the way in which you’d have them complete. Cassie W.

Thought to buy a house which is valued lower than your budget to allow for fix funds. Your inspector may find your family means several repairs. While this is generally speaking an excellent seller’s duty, you will find a beneficial caveat-owner might not have the new repairs completely done, or they may perhaps not look after them the method that you create. You can consult good concession in a cost which is enough to cover solutions.

Set-up bi-a week costs

Developed bi-per week costs throughout the beginning! It’s going to help a great deal finally in fact it is maybe not anything individuals advised all of us. Kristin H.

Bi-weekly mortgages succeed property owners and make repayments all the two weeks as an alternative than monthly. Bi-a week mortgage repayments equal 26 1 / 2 of-payments a-year-a maximum of thirteen complete repayments. This will help to get rid of overall desire will cost you, along with a supplementary percentage can help individuals pay back their home mortgage ultimately. But not, there was a catch-its a company union and cannot be changed month-to-day, so you need certainly to determine if you can preserve with additional costs.

Assets taxation may vary

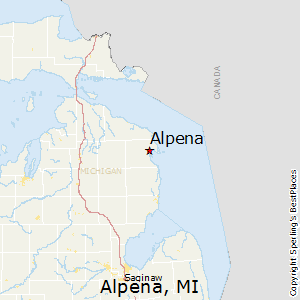

When selecting a home, there are outside a few, such as assets loans Colorado Springs CO taxation. Property taxation can differ immensely because of the county, plus it support financing things like studies, transport, crisis properties, libraries, parks, and you may sport. It’s not managed of the national-rather, it is predicated on condition and you can state income tax levies. According to where you’re discovered, their yearly property goverment tax bill is lower than your home loan-in other section, it can be three to four times your own monthly home loan. Since they are variable and you can place depending, its something to envision if you find yourself deciding the best places to live.

Be equipped for problems

Possess an urgent situation money! All of our septic tank overloaded not long immediately after moving in. I was not prepared for the latest headache otherwise pricing associated with fixing it. Andy C.

Sadly, problems occurs. Your own Cooling and heating device can be split, the products can dysfunction, their cellar you certainly will ton, or you might find some plumbing system situations-in order to label a few. Homeowner’s insurance policies will help counterbalance specific costs, not everything is protected. Because the a tenant, it was relatively easy to deal with this type of emergencies with an instant call into the landlord otherwise possessions repairs. However,, just like the a homeowner, these are today up to you-and they accumulates.

Stay on most useful off program maintenance

Which have property comes maintenance and you can upkeep. Plan for men and women a lot more expenses and stay on top of regime repair to eliminate significant things subsequently. Becky B.

Since the a resident, ongoing repair and restoration are very important to stopping major facts in the the near future. Regular fix includes mowing the yard, clean your exterior, energy laundry, cleaning gutters, replacement heavens filters, or having devices maintained. You should expect you’ll spend ranging from 1% and you can cuatro% of the house’s worthy of yearly to own fix. Including, when your residence is $300,100, you should save between $step 3,one hundred thousand to $several,100 having yearly maintenance. There are lots of other variables to adopt, also, such as your residence’s ages, size, and/or weather near you.