- Around $250 payday loan on the paycheck and a cards-building loan doing $a thousand

- Get a bank account no charges, treated investing, credit history recording plus

- Cash back searching in the biggest stores

- A just about all-in-you to financial and money improve service

- Based savings account at the very least a couple months dated

- Regular earnings dumps

- Family savings reveals an everyday confident harmony

- Fee-totally free cash advance with elective tipping

- $/day registration to possess advanced features such as for instance borrowing from the bank-building money

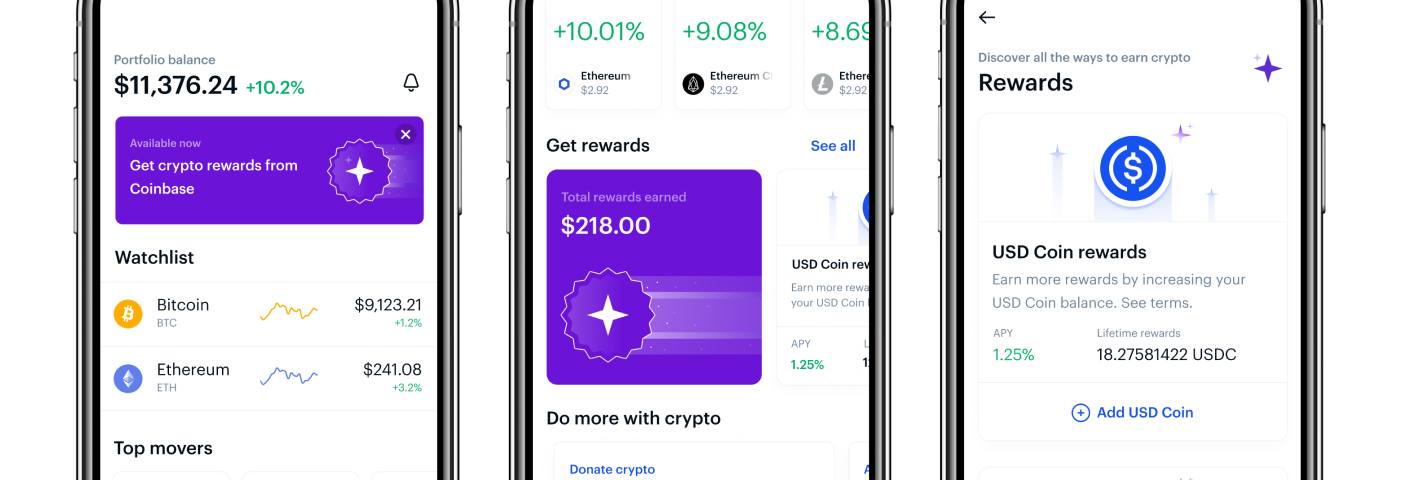

What Apps Enable you to Borrow cash?

Many banking companies, borrowing unions and cash progress apps give you entry to use currency as it’s needed. Payday loans apps can get family savings and you may work criteria, that will limitation what you are able withdraw as an earlier associate. Distributions generally speaking capture a few days to techniques, though you can usually receives a commission instantly to have a fee.

Your own bank or credit commitment can also allows you to use for a loan otherwise payday loan for the-software. Pose a question to your banking facilities just what cellular borrowing functions they provide.

Getting a wage advance

Wage advance properties arrive online, compliment of apps and also at brick-and-mortar loan providers. You will have to complete financial data also money verification, financial comments and potentially use of their family savings.

Pay day loan loan providers may wish to know you’ve got enough normal money to repay the mortgage, an optimistic lender equilibrium and you may compliment investing patterns. When you offer your own and you will financial documents, new pay day bank will determine what characteristics are available to you and you may go over payment solutions, charges and you can interest rates of its qualities.

How do Look at Enhances Really works?

A check improve was a small brief-title unsecured loan constantly reduced into the borrower’s second pay-day. Glance at cash advance, payday loan, payday loans and brief-term loan are common terminology one to source a similar device.

A lender looks at your evidence of income, always a pay stub, along with your condition character to decide whether or not they tend to lend to you personally. Extent borrowed arrives in your next pay day, or even for specific pay day loan activities otherwise choice, is going to be owed in terms of 90 days aside . Loan providers along with charge a portion paid in your loan amount and you can county laws – typically $15 per $100 borrowed.

When to Explore Payday loans Applications

Payday loans applications make you access to your income very early when the you may have costs and other important costs to pay for. They’ve been of use whenever you are inside a tight put and certainly will end overdrafts or any other financial fees.

Cash advances is best whenever a borrower possess suit spending designs, generally discusses its expenditures having extra cash left-over and certainly will with full confidence pay back the brand new withdrawal and you may one costs otherwise rates of interest.

It is really not best if you continuously rely on cash advances for those who might help they. Specific pay-day and money advance features was seemingly reduced-rates, while others has actually APRs as high as 700%. It may be hard to pay off and you will endure continual high priced charges. If you were to think your trust cash advances, thought having a finance talk which have an economic professional to locate choice and personal loan in Kingston TN you will change your financial predicament.

Cash advance apps normally charges pages purchase charge, subscription can cost you or rates to the money borrowed. Though some cost is common, 100 % free and you can reduced-pricing choices are starting to be more widely available.

Exchange costs could be a flat rates otherwise offered since the an enthusiastic optional tip toward solution. Monthly subscription charge initiate at the $1 and you can go of up to $. Interest rates are to have traditional pay day loan or repayment fund, and can go of up to 700% Annual percentage rate.